一、財富傳承中的信託與受託人關鍵地位

在財富管理和傳承中,選擇合適的受託人至關重要。信託作為一種有效的財富管理和傳承工具,其運作依賴於受託人能否妥善履行職責。在某些特定需求下,如家族繼承、企業傳承、資產保護及財富規劃等方面,合適的受託人扮演著不可或缺的角色。

二、信託和受託人的概念

在英國普通法對信託概念的描述下,信託是指一方(委託人)與另一方(受託人)簽訂協議(信託契約),根據協議,委託人將資產的法定所有權轉移給受託人,受託人為第三方(受益人)的利益以信託形式持有這筆資產,受託人將參考委託人的意願,根據受益人的利益對信託內的資產進行管理和分配。

受託人是信託架構中的重要主體之一,是為第三方的利益持有和管理財產的自然人或商業實體,肩負著信託財產的託管責任,受託人需要從受益人的利益出發,依照信託契約和相關法律規定等承擔受託人的義務,以及妥善管理信託財產。受託人的責任包括但不限於確保信託資產安全,參考委託人的意願管理、投資和分配信託資產,以及根據需要及時向有關的監管機構提交和信託相關的信息。

三、受託人的類型有哪些

對於境外信託而言,有資格擔任受託人主體的通常可以是持有信託牌照的境外信託公司、自然人或者是私人信託公司(PTC)。但基於受託人管理信託架構所需要的專業性、穩定性及可持續性等因素的考量,實踐中通常建議選擇持有信託牌照的信託公司作為受託人。主流的信託公司分成銀行系信託公司和獨立信託公司兩類。

1. 獨立信託公司

獨立信託公司具備豐富的信託業務經驗及較強的獨立性、專業性和持續性。總體來看,獨立信託公司可以分為傳統服務商以及新興服務商兩大類。

(1)傳統服務商

市面上不少傳統信託服務商已經有較長時間歷史,積累了豐富的經驗,他們的優勢主要有:

多樣化信託資產:接受包括金融資產、公司股權、不動產等多種海外合規資產作為信託資產。

廣泛的合作網絡:與各類金融機構及專業服務機構建立了合作關係,能為客戶提供較為全面的服務。

知名度較高:經過較長時間發展,服務覆蓋各大主流金融中心,已經在市場上積累了一定的客戶群,獲得了較為廣泛的認可。

同時,傳統服務商也有一定的局限性,主要體現在:

團隊穩定性不高:一些傳統信託服務商,由於股東主要是基金,較常發生被合併或出售等情況,導致團隊變動較為頻繁,對信託日常的運營和管理造成了一定的阻礙。從客戶角度來說,如果客戶經理頻繁變更,或者指令得不到及時執行,用戶體驗可能不夠好。

溝通不夠順暢:不少傳統服務商的公司高層主要以西方人為主,管理模式偏西方,可能不夠熟悉亞太區(特別是中國)客戶的文化背景及思維方式。如果客戶經理與客戶不在一個時區,也可能出現響應速度較慢及服務效率較低的情況。

線上化程度不高:簽訂文件等通常採用傳統紙質形式,線上化程度較低,導致簽約過程耗時較長,成本較高。

(2)新興服務商

隨著時代演變和科技進步,近年來市場上也逐漸衍生出一些新興信託服務商。與傳統服務商相比,新興服務商往往更迅速地適應不斷變化的市場環境,服務更靈活、多元、高效。

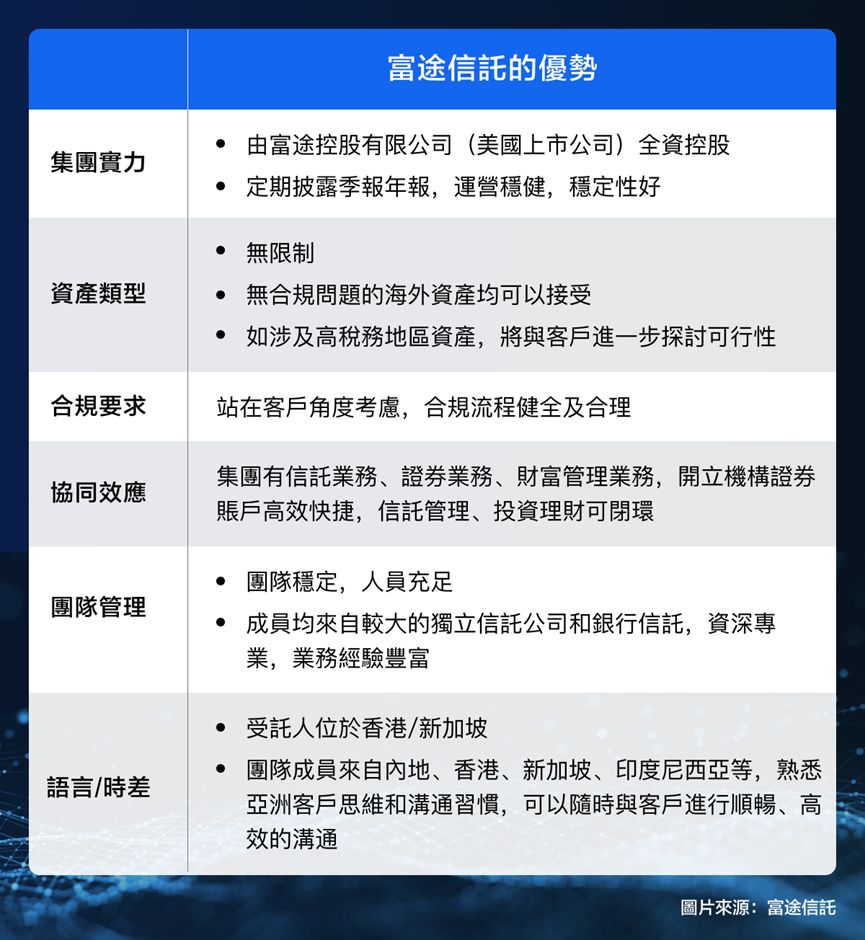

富途信託作為新興信託服務商,優勢主要體現在:

集團實力:由富途控股有限公司全資控股(NASDAQ: FUTU),定期披露運營情況,穩定性好。

專業團隊:團隊穩定,在業內經驗豐富,多名成員為國際信託及資產規劃學會(STEP)會員,專業度高。

響應速度快:受託人位於香港和新加坡,能夠使用普通話、粵語和英語進行溝通,充分適應客戶的語言及文化,響應迅速,服務效率高。

線上化程度較高:在合規條件允許的情況下,可以通過線上Docusign實現信託文件在線签订,大幅节省时间并提升效率;自主研發信託一站式電子化平台,令客戶可以整合各類信託資產,一覽無遺。

2. 銀行系信託公司

許多大型傳統金融機構如私人銀行會提供受託人服務,服務其私人銀行客戶。銀行系信託大多作為私人銀行一部分,受託人重視客戶在其私人銀行帳戶的投資,會更加傾向持有自家帳戶,信託下可持有的資產種類較為單一。

銀行系信託公司具有較為明顯的優點,包括:

股東背景和資源優勢:銀行系信託公司依託於銀行體系,能夠利用股東的客戶資源、資金渠道和品牌實力,在開展業務時享有更多的資源和機會。

良好的風險管理:通常具備完善的風險管理體系和內部控制制度,能夠有效應對風險。

合規性強:需遵循嚴格的審慎監管指標,確保業務的合規性和安全性。

同時,傳統銀行系信託公司也受到一定的局限,比如:

信託資產類型單一:傳統銀行系信託公司主要是爲了服務其私人銀行的客戶,因此常規僅可接受自家私人銀行賬戶下的金融資產作爲信託資產。

資產門檻較高:客戶往往需要滿足較高資產准入門檻,先成為私行客戶,才有資格享受家族信託服務。

流程較繁瑣:由於高風控和合規要求,銀行系信託公司的流程往往較為繁瑣,審批週期較長。

服務模式偏傳統:服務模式相對傳統,外資大行的工作語言多為英語,可能導致與內地客戶的溝通不暢。

線上化程度不高:簽訂協定通常採用傳統紙質形式,線上化程度較低,導致簽約過程耗時較長,成本較高。

這些優缺點使得銀行系信託公司在市場競爭中具有獨特的優勢和挑戰。

三、如何選擇合適的受託人

搭建信託是高淨值人士實現財富管理和傳承的重要路徑,全流程涉及到很多環節,包括信託架構搭建、公司秘書服務、銀行開戶等,是一個系統性的工作。目前市面上的獨立信託公司和銀行系信託公司數量較多,公司實力、服務品質參差不齊,因此委託人應根據自身需求,慎重選擇適合自己的受託人。在篩選合適的受託人時,通常需要考慮以下因素:

1. 公司背景

● 受託人及其母公司(如有)的運營是否穩健,是否具備一定的營收規模及穩定的股權結構

● 受託人是否持有當地監管機構發出的受託人牌照

2. 團隊能力

● 團隊成員是否資深專業,具有豐富的業務經驗

● 團隊管理是否穩定,人員是否充足

● 團隊成員是否具備多語言能力與客戶進行順暢的溝通

3. 服務效率

● 受託人團隊是否能及時響應各個地區的客戶需求

● 是否提供便利高效的信託一站式服務方案,配套服務是否完善

4. 靈活程度

● 受託人是否對可接受的資產種類具備較高的開放性

5. 服務收費

● 信託服務收費及其他相關收費項目是否合理

● 付費流程是否便利高效

在選擇信託公司時,客戶需要綜合考量多重因素,選擇適合的受託人。無論是歷史悠久的老牌信託機構,還是新興服務商,其核心價值在於服務團隊的專業能力和客戶體驗,因此特別要留意考察對接團隊的從業經驗、專業素養以及對客戶需求的深刻理解。

值得留意的是,無論選擇哪家服務商作為受託人,信託僅受限於所選擇的信託契約法律文件受監管的區域以及信託資產所在地等因素,受到所選信託司法管轄區法律(Governing Law)的保護。例如,選擇澤西信託即以澤西作為信託的法律管轄區或由信託下主要資產所在地的法律處理糾紛;另外,所有信託公司無論背景,都需要遵循反洗錢(AML)、反恐、反避稅(如CRS申報)等國際要求,確保信託服務的安全性與合規性。

四、關於富途信託

富途信託及其新加坡公司分別持有香港和新加坡信託業務牌照,團隊成員匯集了來自銀行信託、跨國信託服務提供商和家族辦公室的優秀專家,具備豐富的家族信託和家族辦公室服務經驗。作為香港和新加坡家族信託和家辦服務的受託人和專業服務商,富途信託與專業律師、稅務顧問等合作夥伴合作,在全面了解客戶需求的基礎上,作為受託人協助客戶進行信託和家辦架構的搭建、提供公司秘書服務等,同時還可以結合富途集團在投資交易平台、財富規劃和管理等方面的優勢,為客戶家族提供整體全面的方案,致力於成為客戶信賴的溝通窗口,節省客戶溝通成本,高效地滿足客戶及家族的需求。

截至目前,富途信託已處理超過500個企業和個人客戶的信託諮詢和落地服務,高效回應,備受各行各業的企業和高淨值人士認可。

持牌資訊:

富途信託有限公司和Moomoo Trustee (Singapore) Pte. Ltd.由富途控股有限公司(NASDAQ: FUTU)全資控股。

富途信託有限公司是一家根據香港《反洗錢及反恐融資條例》(第615章)註冊的持牌信託或公司服務供貨商(牌照號碼:TC006475),以及根據香港《受託人條例》(第29章)註冊的信託公司。

Moomoo Trustee (Singapore) Pte. Ltd.是一家根據新加坡法規《信託公司法》 (Trust Companies Act) 持牌的公司,已獲得新加坡金融管理局發出的信託牌照(牌照號碼:TC000074)。